Feast to Famine

We haven’t had an old-fashioned winter in many years, but it’s here now.

By all measurements, we’ve gone from an abundance of propane supply to scarcity. In October there were 69 million barrels of “ready for sale” propane but only 30.9 million barrels were available as of last Friday.

The combination of strong export demand, which was about 27% higher in January than last year, and unrelenting, colder than normal weather, has led to plunging inventory levels and pipeline allocations.

During the past 10 years the lowest propane inventory levels occurred in March (seven times) and April (three times) but with cold weather hanging around we could be scraping the bottom of the barrel much earlier this year.

By the Numbers

Last December, we wrote a blog complementing the EIA’s new product code (The EIA gets an “A”) for breaking out “ready for sale” propane from the original report, which included propane’s share of unfractionated mixed products.

How significant is the difference between the old way of reporting propane inventory levels and the new way? Well, about 30% to 40% depending on the week and region of the country.

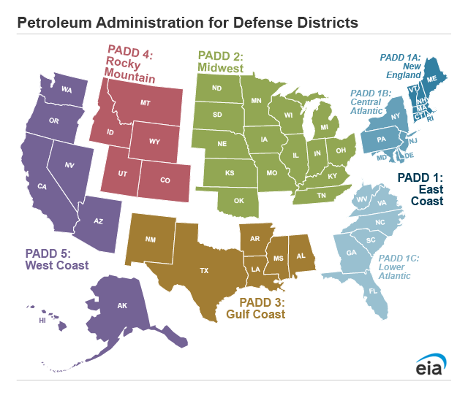

The image below shows the 5 Petroleum Administration for Defense Districts which were created during World War 2 for allocating oil and refined products.

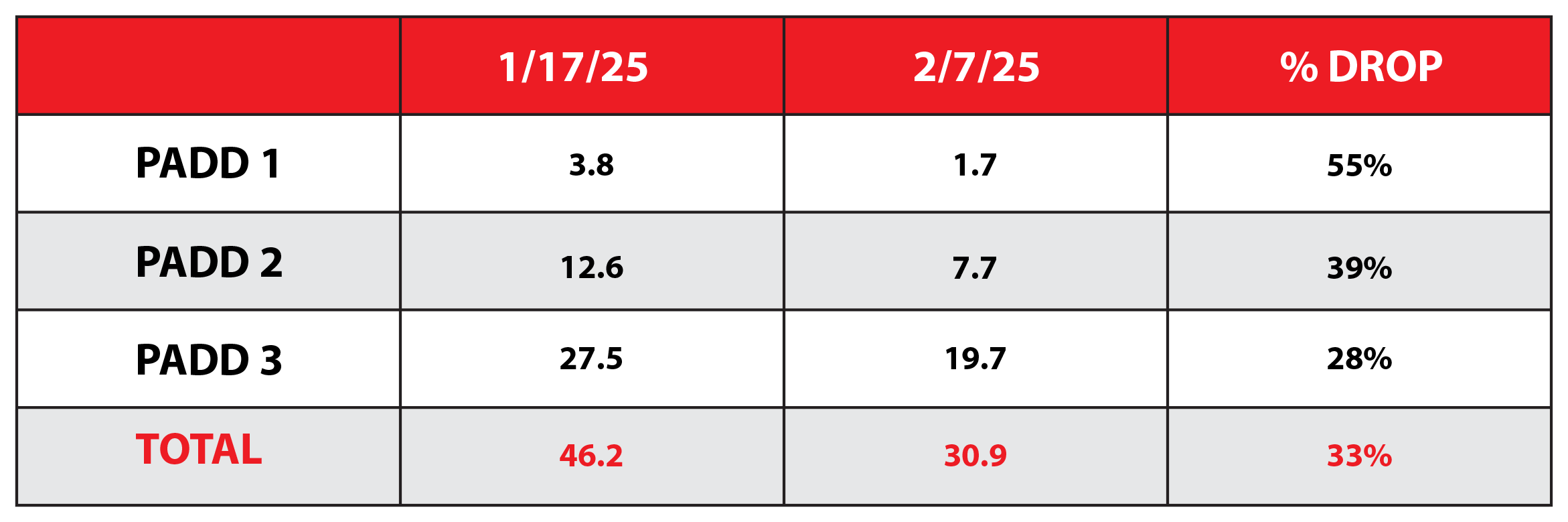

What’s troubling is that “ready for sale” propane inventory levels have dropped precipitously, especially in PADD 1 and PADD 2. Granted, the reported supply at refineries, bulk terminals (with over 2.1 million gallons of fixed storage) and pipelines does not include railcars, but the decline is still alarming.

Here is a table that shows the sharp drop of available propane over the past 3 weeks:

Days of Supply

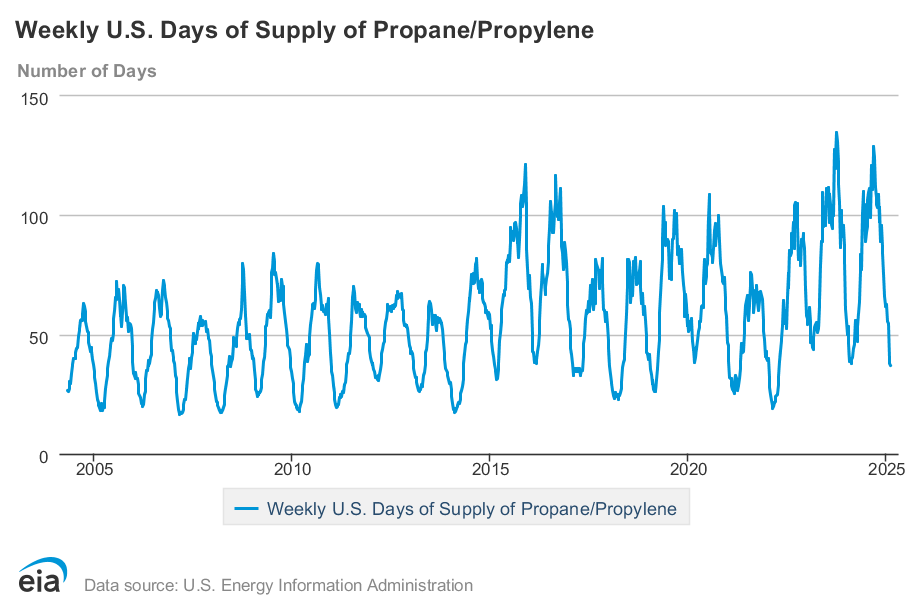

Another measurement of inventory health that the EIA reports is “Days of Supply” which takes current stock levels (using the original method) and divides it by estimated demand over the previous 4 weeks. The low point is usually reached in late February.

Last Wednesday’s report, which included the last week in January, showed only 38 days of supply available. That’s about as low as it’s been since 2022.

NOTE: The weekly update is released after 1 pm EST, so the graph below will be updated in the Heffron Blog later today on the rayenergy.com website.

The Skinny

During cold winters, it sometimes feels like the sky is falling. Inevitably, there are new and stressful challenges. But our propane industry is remarkably adaptive, and the available propane supply in North America will go where it’s needed the most.

For our part, at Ray Energy, be assured that we’re well prepared to meet your upcoming propane requirements. To help us better manage our incoming supply, please lift your contracted volume evenly throughout the month. And if you need more, just let us know.

Happy Valentine’s Day!

Get Stephen's insights on propane delivered to your inbox every month. Sign up for our monthly newsletter here.

For more frequent updates and industry news, join us on LinkedIn.

NOTE: The views and opinions expressed herein are solely those of the author, unless attributed to a third-party source, and do not necessarily reflect the views of Ray Energy Corp, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed by the author to be reliable. However, the author does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does the author recommend that the attached information serve as the basis of any buying decision and it has been provided to you solely for informational purposes.

© 2011-2025 Ray Energy Corp. All rights reserved. Any reproduction, representation, adaptation, translation, and/or transformation, in whole or in part by whatsoever process, of this site or of one or several of its components, is forbidden without the express written authorization from Ray Energy Corp.